This year, we’re bringing in the end of the year with a series: 12 Days ‘til New Years. We’ll continue our tradition of highlighting the most notable brands and spending across ad tech platforms, consumer media, and B2B industries.

As we quickly approach the end of 2020 and our countdown to New Years winds down, we want to highlight how quickly B2B advertisers were able to respond to an overhaul of events, supply chains, and operations.

B2B Commerce and Advertising Shifted Digital

Back in February, advertisers had events lined up, plans set in place, and supply chains in order. They never would have imagined how COVID-19 would rapidly change their ways of working, communicating, and reaching buyers.

The shift to eCommerce

Because of the disruption COVID-19 caused, brands began to buy and sell more through eCommerce. Businesses had already been using online marketplaces, but the pandemic accelerated the trend.

“Brands are increasingly doing assortment expansion via third-party sellers—COVID-19 accelerated this trend because of the demand disruption it caused,” explained Joe Cicman, a senior analyst covering eCommerce at Forrester Research. Not only was there greater demand, but analysts say that customer experiences improved too, making online shopping more accessible.

With more buying and selling online, it was appropriate for B2B advertisers to test new digital marketing approaches. Plus, it was necessary—as the main tool in the B2B marketer’s arsenal was taken from them.

Without events, advertising went digital

According to eMarketer, 43% of U.S. B2B advertisers reported they would shift event budgets to digital advertising this year.

MediaRadar data confirms that advertisers did just that:

- Digital spend in the B2B space reached $1.1B this year—an overall increase of 22% year-over-year.

- 129 thousand brands advertised in the B2B digital space between January and November 2020.

- In July, the difference between 2019 and 2020 reached 48% more spending on digital space this year.

And the shift didn’t necessarily look like moving sponsorships from physical events to virtual.

Only 43% of sponsors and exhibitors from B2B events were seen sponsoring or exhibiting at virtual events between April and September. Sponsors who did shift directly to virtual events were often large spenders—with 50% of their dollars retained in the virtual event or webinar space.

Even though virtual events have advantages, like cost-effectiveness, global reach, and more robust analytics, many leaders predict in-person events to return when it’s safe to do so. In the future, many events might offer an online option for those who can’t attend in person.

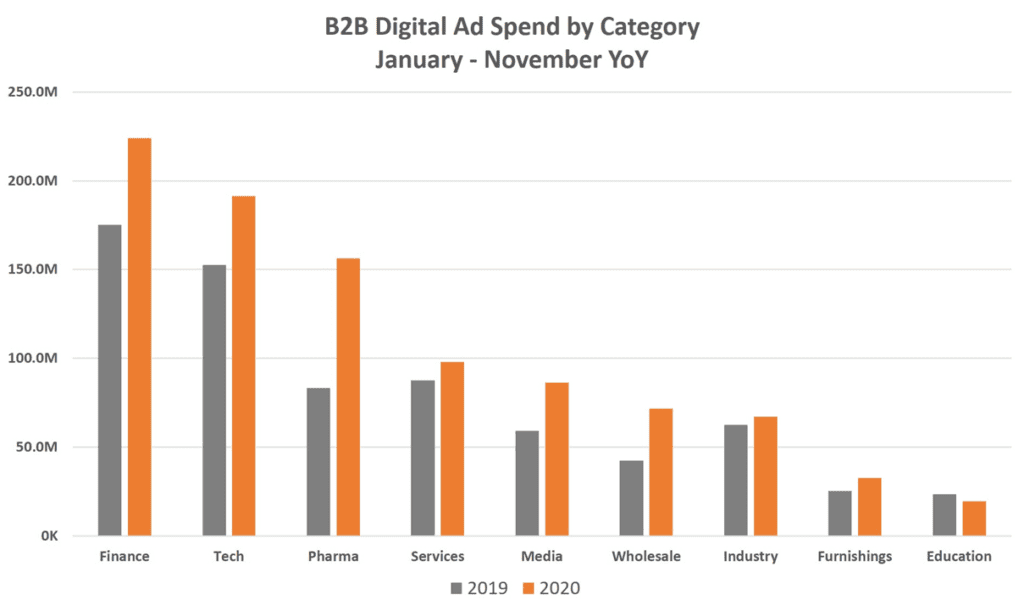

Who were the biggest spenders who went digital in the B2B space this year? The same as last year: Finance, Tech, and Pharma. However, the amount they spent increased significantly. These categories account for 37% of total digital spend.

All the top B2B industry advertisers increased their digital spend, except education. While the pharmaceutical industry made the biggest increase in spending, it’s still the third largest spending industry across digital ad spaces, behind Finance and Tech.

As the vaccine becomes more widespread in the U.S., we’ll see how long these shifts last. Next year, we’ll monitor whether dollars go back to events, if hybrid events become more normal, and what the future of digital advertising and commerce look like for B2B industries. But until then, we’ll continue enjoying the holidays, with their abnormalities and all.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.